All Saving Money

Six ways to enjoy Hawaii without going brokeHawaii is expensive. But while moving or even vacationing there isn't cheap, it can be done.

Six ways to enjoy Hawaii without going brokeHawaii is expensive. But while moving or even vacationing there isn't cheap, it can be done. Seven questions to ask before switching cell-phone carriersYour current cell phone carrier isn’t cutting it anymore, and you’re ready for a change. Pause before you pull the trigger.

Seven questions to ask before switching cell-phone carriersYour current cell phone carrier isn’t cutting it anymore, and you’re ready for a change. Pause before you pull the trigger. Top travel deals: Take the perfect Caribbean cruise in NovemberTake your pick of fall escapes in this week's roundup of the best travel deals. Treat your family to a stay at a Disney resort, book a Western Caribbean cruise, and more.

Top travel deals: Take the perfect Caribbean cruise in NovemberTake your pick of fall escapes in this week's roundup of the best travel deals. Treat your family to a stay at a Disney resort, book a Western Caribbean cruise, and more. Follow these tips to get the best deal every time you shop in-storeShopping at your local brick-and-mortar store shouldn’t deliver a bigger hit to your wallet than shopping online. Here’s how you can guarantee a good deal after you’ve already left home.

Follow these tips to get the best deal every time you shop in-storeShopping at your local brick-and-mortar store shouldn’t deliver a bigger hit to your wallet than shopping online. Here’s how you can guarantee a good deal after you’ve already left home. Why debt management plans don't work for everyoneDebt management plans are touted as an alternative to bankruptcy and an affordable way to pay back credit card debt. But bankruptcy is sometimes a better choice, and dropping out of a plan can have serious consequences.

Why debt management plans don't work for everyoneDebt management plans are touted as an alternative to bankruptcy and an affordable way to pay back credit card debt. But bankruptcy is sometimes a better choice, and dropping out of a plan can have serious consequences. Southerners are happy with their salaries, survey findsHow does your location affect your financial concerns? We cover regional differences in debt, money worries, and more.

Southerners are happy with their salaries, survey findsHow does your location affect your financial concerns? We cover regional differences in debt, money worries, and more. Two credit cards that extend benefits to authorized usersAn authorized user on a credit card account is someone who has a card in their name, but is not directly responsible for paying the bill. Many credit card companies offer incentives for adding an authorized user to your account.

Two credit cards that extend benefits to authorized usersAn authorized user on a credit card account is someone who has a card in their name, but is not directly responsible for paying the bill. Many credit card companies offer incentives for adding an authorized user to your account. You share utilities with your roommates. Why not your phone bill?Having roommates may already lower your cost of living: You share rent, utilities, maybe even food. If you’re managing expenses collectively, a shared cell phone bill shouldn’t be too much extra trouble.

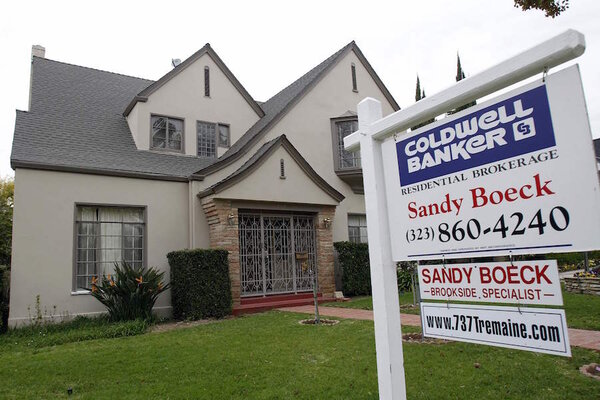

You share utilities with your roommates. Why not your phone bill?Having roommates may already lower your cost of living: You share rent, utilities, maybe even food. If you’re managing expenses collectively, a shared cell phone bill shouldn’t be too much extra trouble. Should I keep renting or buy a house?The jump renting or owning is a huge financial step, not just a change in lifestyle. You’ll need a potentially hefty down payment, solid credit and a plan to live in the same place for long enough to make buying worth your time and money.

Should I keep renting or buy a house?The jump renting or owning is a huge financial step, not just a change in lifestyle. You’ll need a potentially hefty down payment, solid credit and a plan to live in the same place for long enough to make buying worth your time and money. Best women's fashion dealsRevamp your fitness wardrobe and snag a late-summer look in the week's best women's fashion deals.

Best women's fashion dealsRevamp your fitness wardrobe and snag a late-summer look in the week's best women's fashion deals. Four ways to save without your savings accountA saving strategy that doesn’t feature a savings account might seem counterintuitive, like trying to get in shape without a gym membership. But you don’t need elaborate equipment to break a sweat, and you don’t have to depend on your savings account to boost your nest egg.

Four ways to save without your savings accountA saving strategy that doesn’t feature a savings account might seem counterintuitive, like trying to get in shape without a gym membership. But you don’t need elaborate equipment to break a sweat, and you don’t have to depend on your savings account to boost your nest egg. September is the perfect time to buy these nine thingsBut unfortunately, it's not a good time to score a deal on the iPhone 7, an iPad, or a large appliance.

September is the perfect time to buy these nine thingsBut unfortunately, it's not a good time to score a deal on the iPhone 7, an iPad, or a large appliance. Super shoe deals: $1 flip flops, Nikes for under $35You'll find casual picks and dressy kicks in this week's roundup of the best shoe deals.

Super shoe deals: $1 flip flops, Nikes for under $35You'll find casual picks and dressy kicks in this week's roundup of the best shoe deals. HARP loan extended through 2017, offering relief to underwater homeownersThe FHFA estimates that over 300,000 homeowners who owe more than their home is worth could still refinance through the Home Affordable Refinance Program (HARP) to lower their monthly payments and avoid foreclosure.

HARP loan extended through 2017, offering relief to underwater homeownersThe FHFA estimates that over 300,000 homeowners who owe more than their home is worth could still refinance through the Home Affordable Refinance Program (HARP) to lower their monthly payments and avoid foreclosure. Five DIY kitchen upgrades under $100The kitchen is, on average, the room that will add the most value to a home, and a few low-cost upgrades can yield a huge return on investment.

Five DIY kitchen upgrades under $100The kitchen is, on average, the room that will add the most value to a home, and a few low-cost upgrades can yield a huge return on investment. Amazon launches car comparison site as auto buying moves onlineEdmunds.com, TrueCars and Kelley Blue Book are among the main resources consumers currently use to research cars and get pricing quotes from dealers. If Amazon were to establish links to local dealers, it could become a formidable competitor.

Amazon launches car comparison site as auto buying moves onlineEdmunds.com, TrueCars and Kelley Blue Book are among the main resources consumers currently use to research cars and get pricing quotes from dealers. If Amazon were to establish links to local dealers, it could become a formidable competitor. Here's how much you should be saving for collegeWith some thoughtful planning, you can come up with a reasonable estimate of your 'magic number' for college savings.

Here's how much you should be saving for collegeWith some thoughtful planning, you can come up with a reasonable estimate of your 'magic number' for college savings. Your personal finance guide to America's national parksWhether you’re a first-time camper or an old pro, here are some tips to save money in and around the parks.

Your personal finance guide to America's national parksWhether you’re a first-time camper or an old pro, here are some tips to save money in and around the parks. Why you need a separate bank account for your side jobOne of the first things to do when taking up a side job is to open a separate bank account specifically for it. The point is to create a system to track business and personal expenses separately.

Why you need a separate bank account for your side jobOne of the first things to do when taking up a side job is to open a separate bank account specifically for it. The point is to create a system to track business and personal expenses separately. Getting a new credit card? Six questions to ask your issuer.Your credit card issuer may be willing to help with things like managing payments, raising credit limits, and more.

Getting a new credit card? Six questions to ask your issuer.Your credit card issuer may be willing to help with things like managing payments, raising credit limits, and more.