Obama's missed opportunity: What should he have said?

Loading...

Why is there an enthusiasm gap? Let me illustrate.

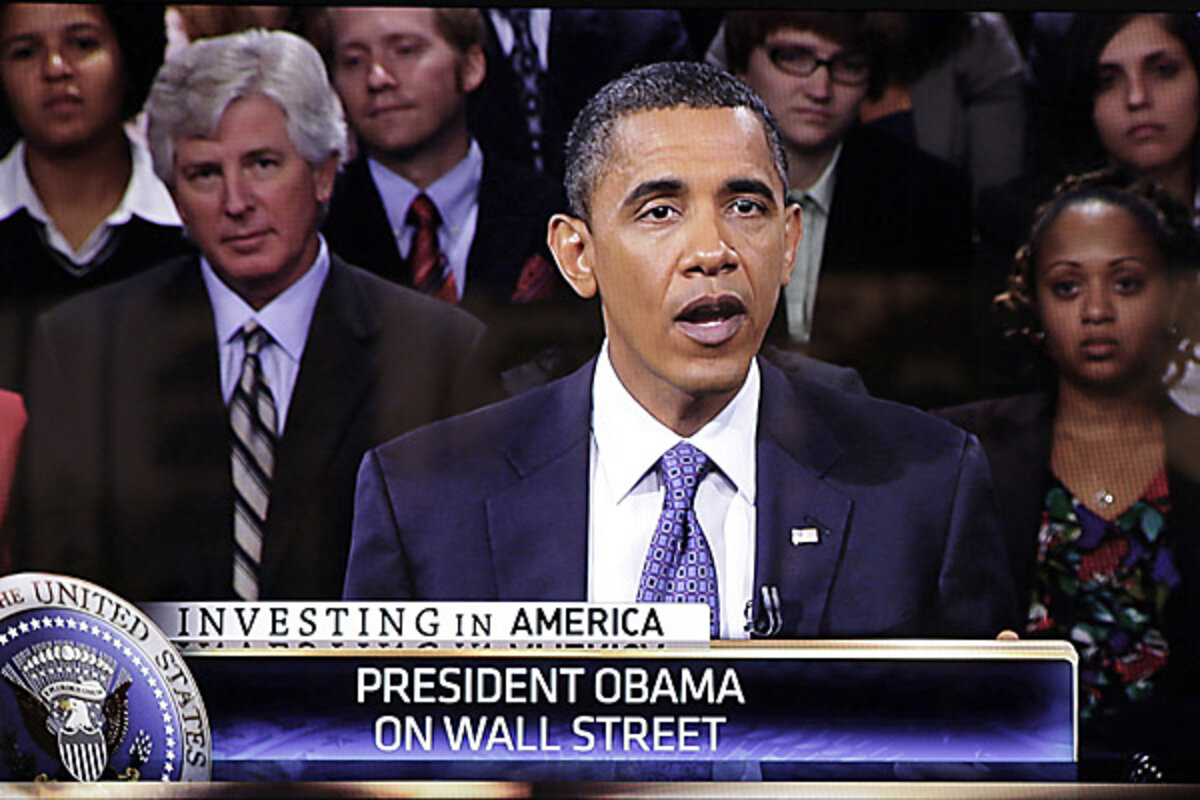

Today (Monday) at a “town hall” sponsored by CNBC in Washington, the President took questions about the economy. When a hedge-fund manager complained that Wall Street executives “feel like we’ve been whacked with a stick” by the administration, Obama said most of his critics think he’s been too soft on the Street.

He noted he still hasn’t been able to end the practice of taxing some hedge fund and private-equity earnings at the capital-gains rates rather than the higher income-tax rates. “The notion that somehow me saying maybe you should be taxed more like your secretary when you’re pulling home a billion dollars…a year I don’t think is me being extremist or anti-business.”

Good as far as he went. But that’s as far as he was willing to go. It was a golden opportunity for Obama to connect the dots — to make the case that

(1) super-rich financiers on Wall Street and top corporate executives have grown even richer than they were before the Great Recession, even though most Americans are getting poorer or losing their jobs and homes and savings, and more Americans are in poverty.

(2) Yet the lobbyists for the financiers and top corporate executives, and their Republican allies have blocked or tried to block every effort of the Administration to widen the circle of prosperity, including enacting a major jobs program, providing major relief for mortgage holders who are under water, helping working families afford college for their kids, making sure states and cities have enough money to pay our classroom teachers, and cutting taxes on average working people.

(3) They almost scuttled the effort to make sure health care would be affordable to average Americans.

(4) The super-rich say the nation can’t afford any of this because of budget deficits. Yet at the same time their platoons of lobbyists are fighting off efforts to treat their income as taxable earnings rather than capital gains. So last year the 400 richest families in America, with an average income of $300 million each, were taxed at an average rate of only 17 percent. That’s the same tax rate paid by a family earning $30,000.

(5) And they’re fighting off efforts to end the temporary Bush tax cuts. If they’re successful, the richest 1 percent of Americans will get a windfall of $36 billion next year. Millionaire families will avoid paying $31 billion in taxes. Over ten years, they’d avoid paying $700 billion.

(6) And they’re fighting off efforts to restore the estate tax, which only applies to the top 2 percent of Americans, and which has been in effect since Abraham Lincoln introduced it to help finance the Civil War. How do we afford national defense if the richest and most privileged Americans won’t pay their fair share?

(7) Wealth and power in this country are so distorted that the top 25 hedge-fund managers each earned an average of $1 billion last year. $1 billion would support 20,000 classroom teachers. Yet who contributes more to this country — a hedge-fund manager or a teacher?

But he didn’t.

Instead, he challenged tea-party activists to come up with specific spending cuts. “It’s not enough just to say, ‘Get control of spending.’ I think it’s important for you to say, you know, I’m willing to cut veterans’ benefits, or I’m willing to cut Medicare or Social Security benefits, or I’m willing to see taxes go up.”

------------------------------

���Ǵ��� has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. This post originally ran on